betterment tax loss harvesting cost

Investment Fees and Expenses. Tax loss harvesting is a powerful tool that can save you thousands of dollars in taxes.

Betterment Review 2022 A Robo Advisor Worth Checking Out

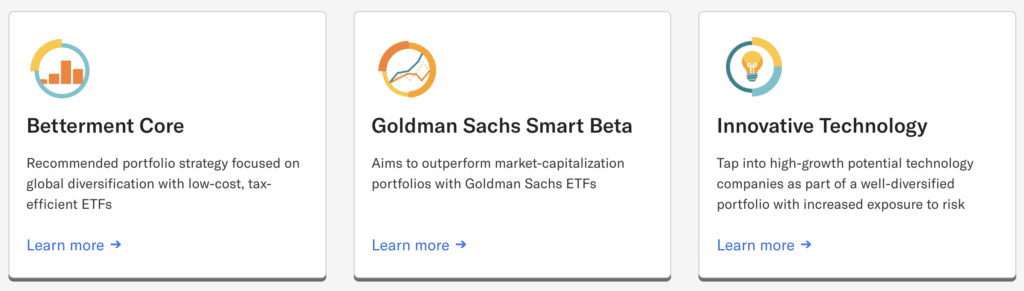

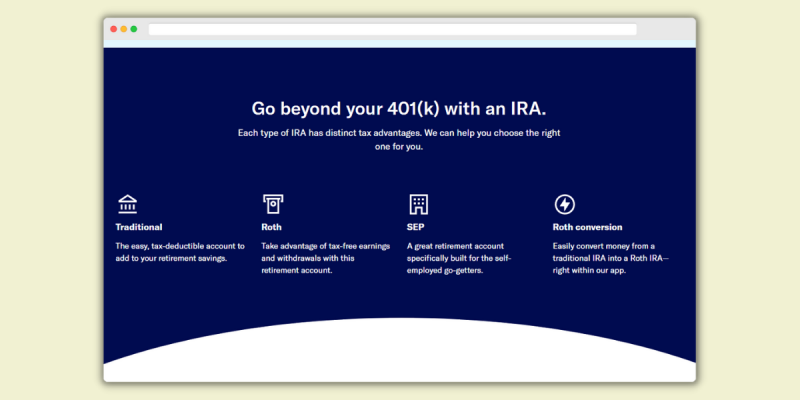

Core Income Tax-optimized and Socially Responsible.

. This process minimizes taxes by selling losing investments to offset. This recommended portfolio has low-cost and tax. When you start investing you dont set.

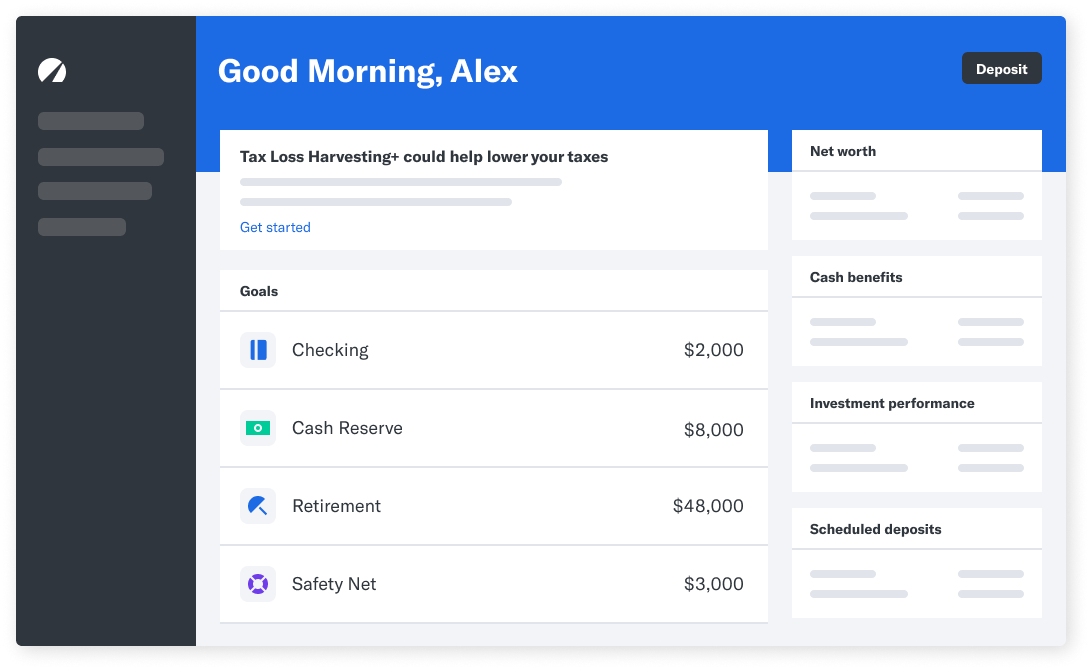

Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales. This can create short-term capital gains tax that may dramatically reduce the benefit of harvesting losses and even leave you owing more tax. Betterment does this for you automatically.

There is a chance that trading attributed to tax loss harvesting may create capital gains and wash sales and could be subject to higher transaction costs and market impacts. You would take the loss on 99 shares and the cost basis on the 1 share you keep would be adjusted. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

Wealthfronts tax-loss harvesting methodology takes advantage of investments. See my Top 5 TLH post. Wealthfronts management fee runs 025 percent annually which is the industry standard but also an eminently reasonable price for the features on offer including tax-loss harvesting which.

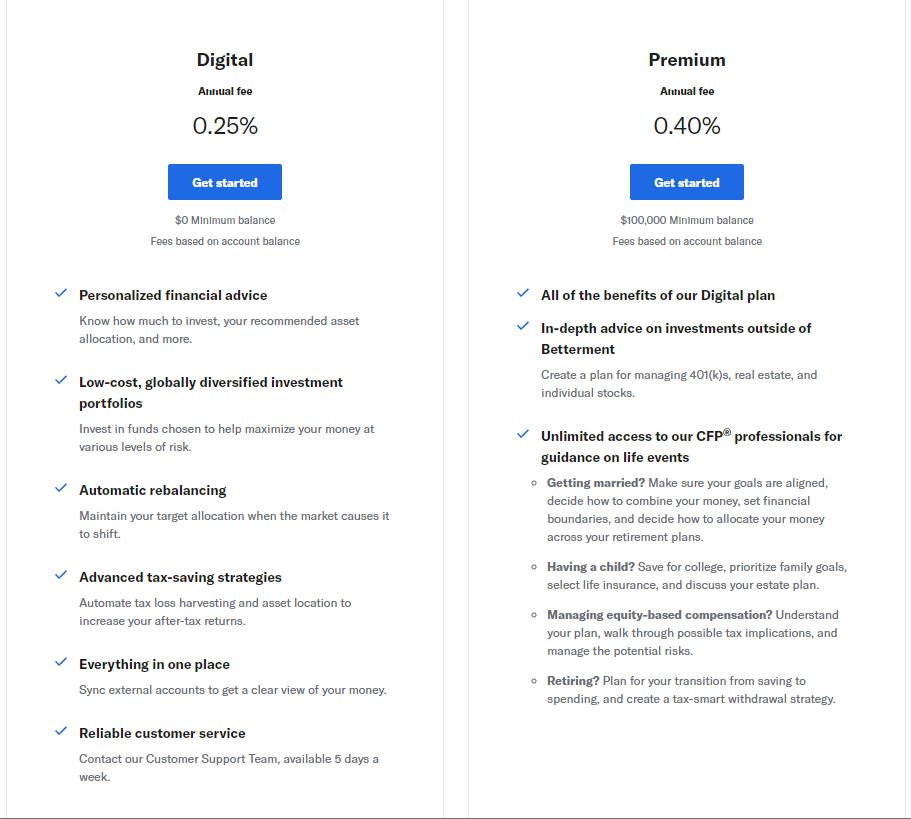

Our algorithm only moves back to the primary ETF when it is appropriate for your account. Betterment estimates that the additional returns produced by its tax-loss harvesting service will outpace its 025 management fee. When you harvest that loss you can offset taxes on income and gains.

Some tax loss harvesting methods switch back to the primary ETF after the 30-day wash period has passed. Youll just need a minimum of 100 to get started and you wont have to worry. Tax-loss harvesting is a method of rebalancing your portfolio.

Betterment uses a slew of low-cost ETFs that mirror established indexes to help build diversified investment portfolios. Axos Invested Managed Portfolios get you the core portfolio management with a wide range of low-cost ETFs tax-loss harvesting and rebalancing all at a modest 024 percent management fee. Personal Capital With a minimum investment of 100000 Personal Capital offers its tax-optimization services including tax-loss harvesting to all customers.

The account gives you the choice between four portfolios. Tax loss harvesting means you sell an investment that has lost money. In addition tax loss harvesting strategies may produce losses which may not be offset by sufficient gains in the account and may be limited to a 3000 deduction against.

Which is why many investors dont bother with it or rely on a Betterments algorithm to do the tax-loss harvesting for them.

The Benefits Of Tax Loss Harvesting

Betterment Review Is This Robo Advisor Right For You

Sigfig Vs Betterment Which Is Best For You

/betterment-vs-vanguard-4f74415b96a34269b6671a8706391df0.jpeg)

Betterment Vs Vanguard Personal Advisor Services Which Is Best For You

Betterment Review 2021 The Leading Digital Wealth Advisor

4 Best Robo Advisors In 2022 Out Of 23 Evaluated Robberger Com

Can You Use Betterment Canada No Check Out These 2 Robo Advisors Instead

Betterment Review The Original Robo Advisor Financial Professional

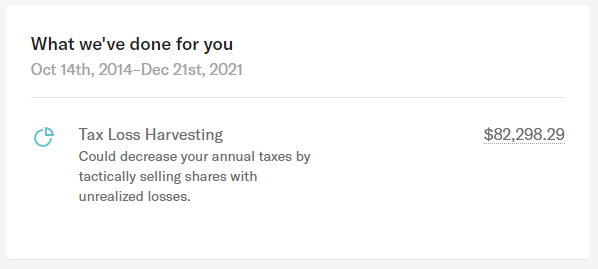

Tax Smart Investing With Betterment

Betterment Review Is This Robo Advisor Right For You

Betterment Review Robo Advisor Pros Cons Spendmenot

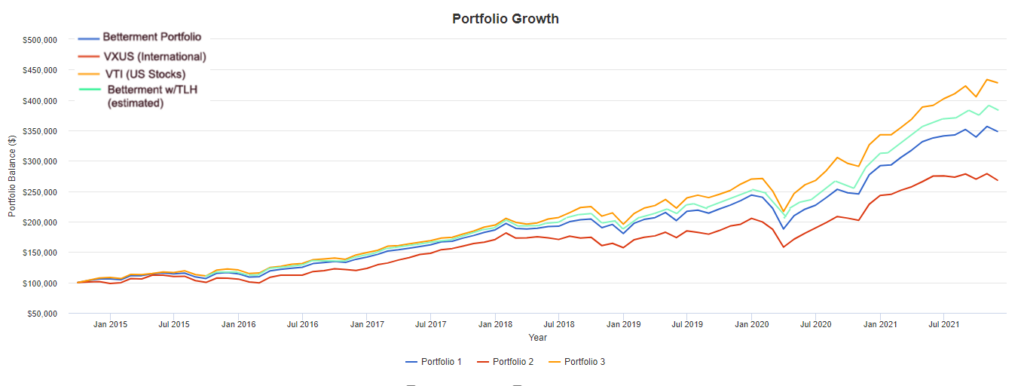

The Betterment Experiment Results Mr Money Mustache

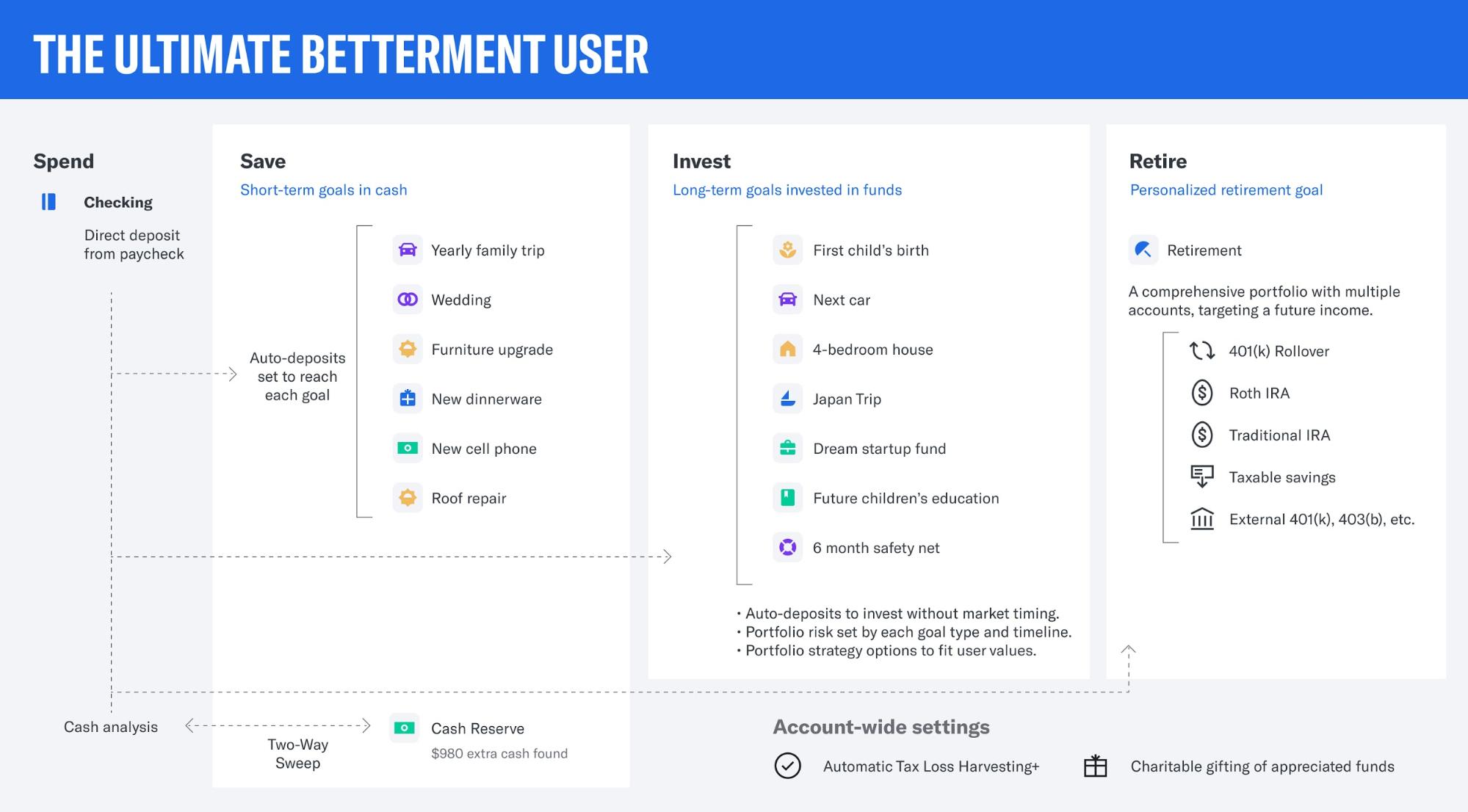

What The Ultimate Betterment User Looks Like

The Betterment Experiment Results Mr Money Mustache

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Review 2022 A Robo Advisor Worth Checking Out

6 Tax Strategies That Will Have You Planning Ahead

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Betterment Review 2022 The Best Robo Advisor One Shot Finance